If you have any questions you’d like answered before moving forward, please send us an email or call, and we’ll be happy to spend more time learning more about you and your business. The higher your Gross Profit percentage, the healthier your business and the more profit you’ll take home at the end of the day. Paychex offers funding solutions that help transform your unpaid invoices into working capital now. When both margins decrease, that could mean you need to cut expenses somewhere. If both margins increase, it could be because of a recent trend you can invest in. Your GPM will increase because lattes have lower COGS than flat whites—flat whites use more milk.

What is a good gross profit margin for a small business?

Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. Therefore, like the use of valuation multiples on comps analysis, the gross profit must be converted into a percentage, i.e. how to calculate and record the bad debt expense the gross margin, as we illustrated earlier. Costs such as utilities, rent, insurance, or supplies are unavoidable and relatively fixed, while gross profit is dictated by net revenue and cost of goods sold.

What is Qualified Business Income?

In short, this percentage becomes a valuation metric for every business that wants to know how efficient its allocation of resources and expenditure towards the production of items is. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

How to Calculate Gross Profit

In contrast, industries like clothing sales tend to have high input costs since they have to account for both labor and materials. A clothing retailer might have a gross profit margin of anywhere from 5% to 13% and still be considered a healthy business. Gross profit only considers direct production costs, while net profit accounts for all expenses, including operating costs, taxes, and interest. As of September 28, 2019, Apple Inc. has sold products and services worth $213,833 million and $46,291 million.

Low or negative gross profits mean that costs exceed income and that a company may need to reassess its strategy. Gross profit is an important metric for assessing a company’s efficiency and productivity. A negative gross profit means the costs of doing business exceed the revenue brought in from sales. Positive gross profit means that a business is successfully covering its basic production costs.

Margins will vary significantly by industry, company size, and market conditions. For example, a car dealership in the automotive industry will have a much lower gross profit margin than a bank in the financial services industry. This also illustrates that service industries that don’t sell physical products generally have higher gross profit margins because they have a much lower COGS than those that produce actual products. Gross profit margin, also known as the gross profit ratio, is a metric used to determine what percentage of the company’s revenue is profit. A higher gross profit margin will indicate a greater ability for a company to control costs.

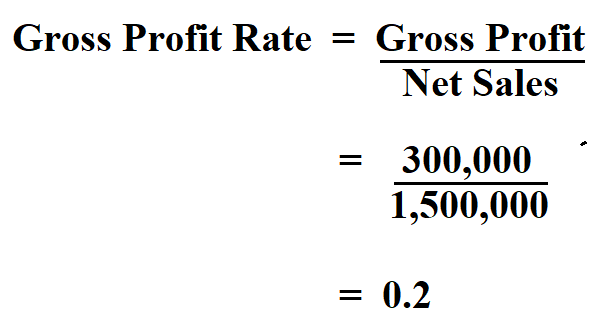

To calculate a company’s net profit margin, subtract the COGS, operating expenses, other expenses, interest, and taxes from its revenue. Then, divide this figure by the total revenue for the period and multiply by 100 to get the percentage. Compare companies’ gross profit margins within the same industry to identify which companies are performing well and which are lagging. The percentage of gross profit achieved by a company in relation to its total sales.

Consider the following quarterly income statement where a company has $100,000 in revenues and $75,000 in cost of goods sold. Under expenses, the calculation would not include selling, general, and administrative (SG&A) expenses. To arrive at the gross profit total, the $100,000 in revenues would subtract $75,000 in cost of goods sold to equal $25,000. Gross profit helps evaluate how well a company manages production, labor costs, raw material sourcing, and manufacturing spoilage. Net income assesses whether the operation is profitable, including administrative costs, rent, insurance, and taxes.

This can be a delicate balancing act, requiring careful management to avoid losing customers while maintaining profitability. Gross profit measures a company’s profitability by subtracting the cost of goods sold (COGS) from its sales revenue. It is usually used to assess how efficiently a company manages labor and supplies in production. Gross profit considers variable costs, which vary compared to production output, but does not take fixed costs into account. If you find that your gross profit margin does not grow, it’s an opportunity to re-examine your pricing strategy, assess your operational efficiency, or re-consider your vendors. This helps you to either increase your total revenue or decrease your operating costs.

- You can also use your gross margin percentage to compare your profits to those of similar businesses in your industry.

- While there are several ways you can track and manage your cash flow, gross profit is one of the top contenders.

- GM had a low margin and wasn’t making much money one each car they were producing, but GM was profitable.

- Additionally, the subsequent cost breakdown is offered; based on the provided data, determine the company’s annual gross profit %.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The historical net sales and cost of sales data reported on Apple’s latest 10-K is posted in the table below. Get inspired with growth insights & tips from experts in the marketing industry. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

An increase may indicate that recent changes are working and should be enhanced or continued. It shows insights into the efficiency of a company in managing its production costs, such as labor and supplies, in order to generate income from the sales of its goods and services. Gross profit and gross margin are the two terms that are widely used in the financial sector. While gross profit is the total revenue generated by a firm, gross margin is the COGS being subtracted from the net sales. Profit percentage is more than just a financial metric it’s a powerful tool that can drive strategic decision-making and business growth.